Death of Seamless Flow of ITC in 2022 – Major Changes under GST

5 (353) In stock

The wonder baby seamless flow of ITC which raised so many hopes and reduced the burdens, had been slowly placed into precarious health condition of late. On the Budget 2022 day it has been put on ventilator with no hope of recovery. The day when changes of Finance Act, 2022 are put into effect would be the date of death of seamless flow of ITC.

Part 9-GST - Areas of Business Impacted (1)

Construction, Rent Out Property, SC to Resolve GST ITC

Not Maintaining Proper Documentation - FasterCapital

Why Old Playbook of Growing D2C Channel is Dead in the New Normal

DOSSIER of Clubs, Associations under GST

MS Feb 2022 by exhibition showcase - Issuu

Pilot Project of Biometric Aadhaar Verification for GST Registration

MCCI Annual Report 2021 - 2022 by Madraschamber - Issuu

How to prepare for GST

QRMP Scheme under GST w.e.f. 01st Jan 2021

Budget 2024 Expectations Highlights: NPS changes, infrastructure

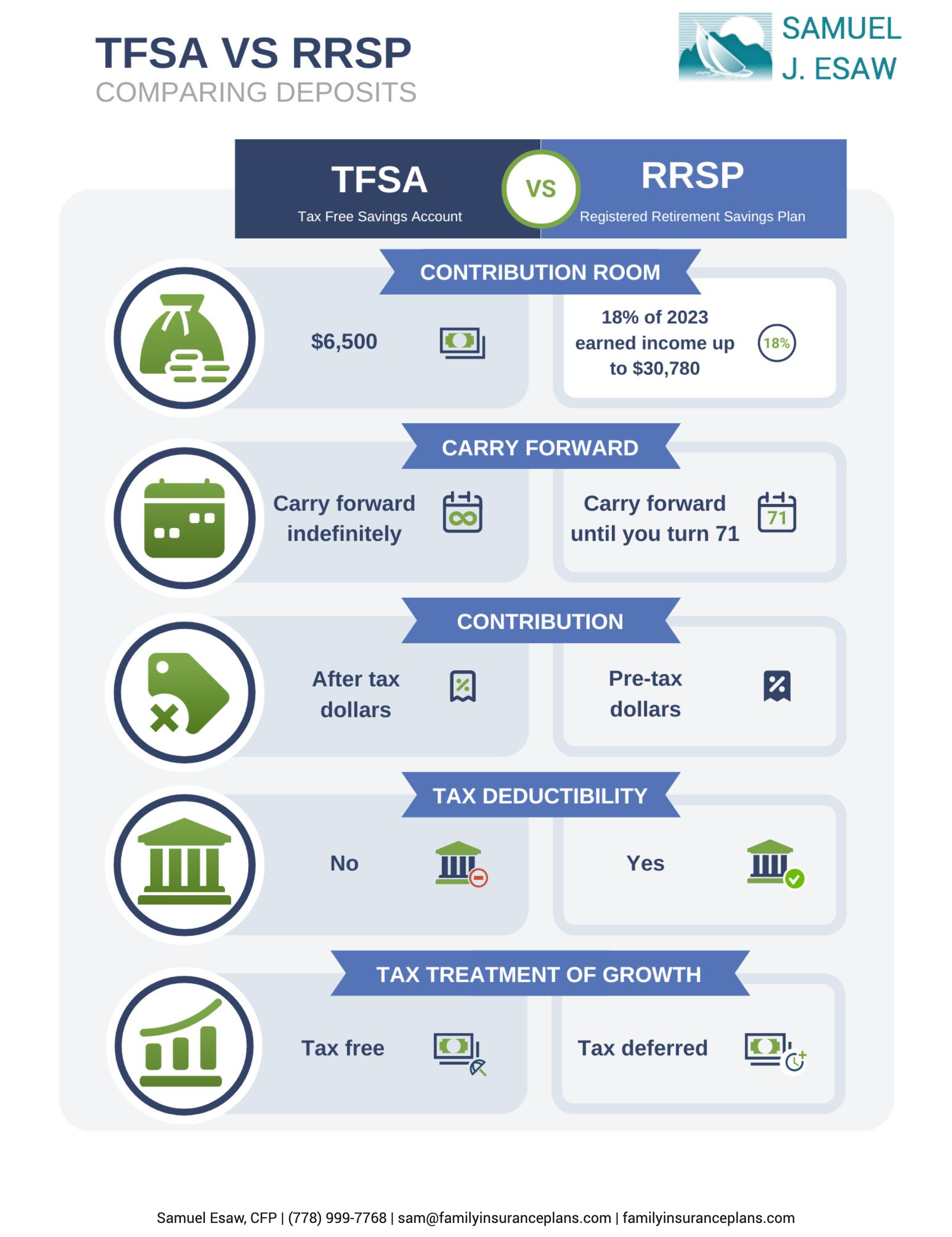

Blog – Samuel J. Esaw

Input tax credit under GST

GST New Era in 2022: Important Changes effective 1st Jan, 2022

What is GST, and how does it differ from the previous tax system

Creating a seamless User flow: Tips for UX design, by DesignGuru

Solved To enable the seamless flow of data across the

Not a lot of “pattern dividers” in this piece. A seamless flow from the center outward 🩵✨

Biometrics, the new normal: How to implement an end-to-end

Border flower graphic Pattern Floral Seamless Flow by sytacdesign

ROLL HARD MMA Grappling Socks

ROLL HARD MMA Grappling Socks 13 Best Shaping Hose and Tights According to Real Buyers - Slenderberry

13 Best Shaping Hose and Tights According to Real Buyers - Slenderberry Anderson Metals Brass Flare Tee, Lead Free, 1/4 In.

Anderson Metals Brass Flare Tee, Lead Free, 1/4 In. Should Curvy Women Go to Church? – Affluent Blacks of Dallas

Should Curvy Women Go to Church? – Affluent Blacks of Dallas NOVOLAN 2PCS Women's Sports Bras Tank Top Seamless Push Up Underwear One Piece Women's Ice Silk Beautiful Back Sports Yoga Vest Bra Workout Fitness

NOVOLAN 2PCS Women's Sports Bras Tank Top Seamless Push Up Underwear One Piece Women's Ice Silk Beautiful Back Sports Yoga Vest Bra Workout Fitness Buy Zivame Double Layered Non-Wired Full Coverage Super Support Bra - Deep Cobalt online

Buy Zivame Double Layered Non-Wired Full Coverage Super Support Bra - Deep Cobalt online