Collateral damage: Foreclosures and new mortgage lending in the 1930s

4.9 (773) In stock

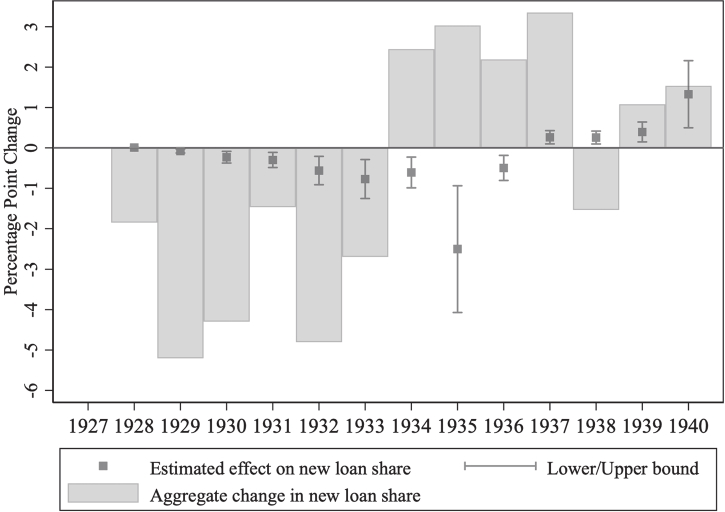

Although severe crises in housing markets contributed to both the Great Recession of 2007 and the Great Depression of the 1930s, the role that housing-related financial frictions played in the crises has yet to be explored. This column investigates the impact that foreclosures had on the supply of new home mortgage loans during the housing crisis of the 1930s. It shows that an increase in foreclosed real estate on a building and loan associations’ balance sheets had a powerful and negative effect on new mortgage lending during the 1930s.

Collateral Damage From Fed Policy (2) – A Broken Housing Market

FRB: Finance and Economics Discussion Series: Screen Reader Version - The Prolonged Resolution of Troubled Real Estate Lenders During the 1930s

Housing Finance Fact or Fiction? FHA Pioneered the 30-year Fixed Rate Mortgage During the Great Depression?

Collateral Damage: The Impact of Foreclosures on New Home Mortgage Lending in the 1930s, The Journal of Economic History

Mortgage Services and Foreclosure Practices

The Mecklenburg Times September 13, 2022 by SC Biz News - Issuu

Collateral damage: Foreclosures and new mortgage lending in the

Collateral Damage From Fed Policy (2) – A Broken Housing Market

Books: mortgage debt

FRB: Finance and Economics Discussion Series: Screen Reader Version -A Primer on Farm Mortgage Debt Relief Programs during the 1930s

A Child's Life in the 1930s Compared to Today

COVID-19's Best Analog Is the 1930s Dust Bowl, Not the 1918 Flu

Jazz History by Decade - The 1930s and Swing

1930 – 1940 John Steinbeck's Historical Context

Collateral damage: Foreclosures and new mortgage lending in the

China Manufactory Brass Ferrule Hose Concrete Pump Water Fitting

China Manufactory Brass Ferrule Hose Concrete Pump Water Fitting Wholesale High Quality Fashion Active Waterproof Anti-Toxic Eco Friendly Legging Sportswear Home Gym Fitness Yoga Wear Set Pants for Women - China Yoga Wear and Yoga Set price

Wholesale High Quality Fashion Active Waterproof Anti-Toxic Eco Friendly Legging Sportswear Home Gym Fitness Yoga Wear Set Pants for Women - China Yoga Wear and Yoga Set price Bon Bon Up Jeans Levanta cola jeans colombianos butt lifter levanta pompis 6702

Bon Bon Up Jeans Levanta cola jeans colombianos butt lifter levanta pompis 6702 9x Anti Slip Bra Strap Clips Cleavage Control Clips Hide Bra Strap Concealer Holders Adjust Converter

9x Anti Slip Bra Strap Clips Cleavage Control Clips Hide Bra Strap Concealer Holders Adjust Converter Hue Women's Capri Leggings

Hue Women's Capri Leggings Teen Girls Japanese Kawaii Lolita Costume Plush Cute Bear Suspender Dress Sweet High Waist Princess Party Dresses (as1, Alpha, l, Regular, Brown, Large) : Clothing, Shoes & Jewelry

Teen Girls Japanese Kawaii Lolita Costume Plush Cute Bear Suspender Dress Sweet High Waist Princess Party Dresses (as1, Alpha, l, Regular, Brown, Large) : Clothing, Shoes & Jewelry