Instructions for Form 8995-A (2023)

4.8 (514) In stock

Instructions for Form 8995-A - Introductory Material Future Developments General I

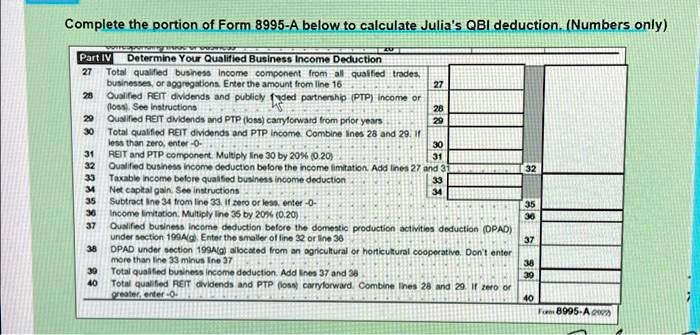

SOLVED: Text: Complete the portion of Form 8995-A below to calculate Julia's QBI deduction. (Numbers only) Part IV: Determine Your Qualified Business Income Deduction Total qualified business income component from qualified businesses

Recession-Proof Your Business: What to Know About Taxes if Struggling in 2023

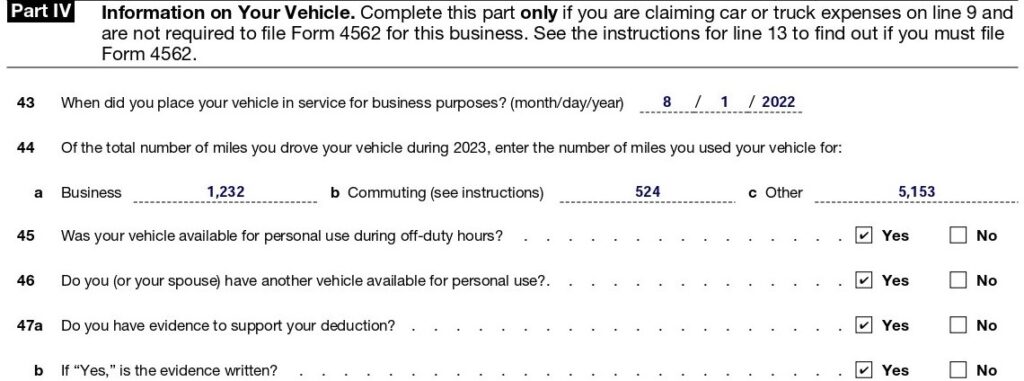

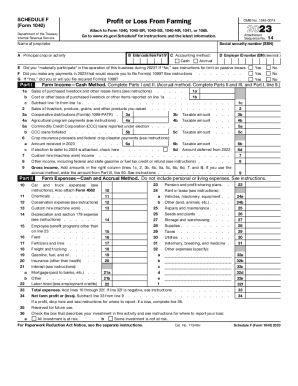

How To Fill Out Schedule C in 2024 (With Example)

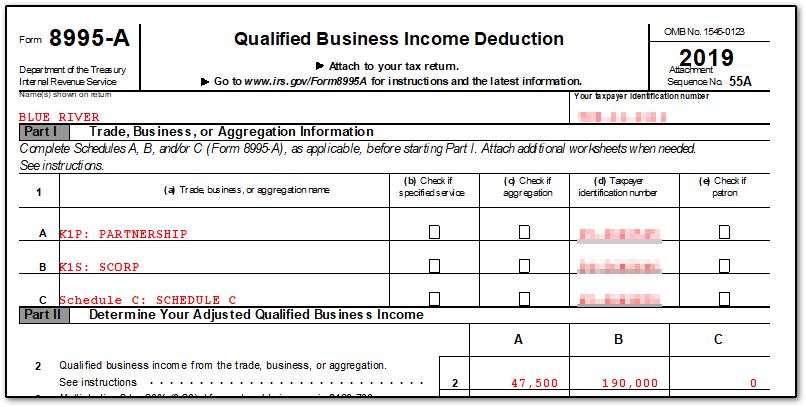

Form 8995-A - Schedule C Loss Netting and Carryforward (K1, ScheduleC, ScheduleE, ScheduleF)

What is Form 8995-A? - TurboTax Tax Tips & Videos

2023 Form IRS 8995 Fill Online, Printable, Fillable, Blank - pdfFiller

form 8995 instructions –

Schedule D (Form 8995-A) Fill and sign online with Lumin

Download Instructions for IRS Form 8995-A Deduction for Qualified Business Income PDF, 2022

Section 199A DPAD Q & A CLA (CliftonLarsonAllen)

Basics 4-Pack AAA Alkaline High-Performance

Differences Between AA And AAA Battery-use, Size, Capacity, MAh

/i.s3.glbimg.com/v1/AUTH_51f0194726ca4cae994c33379977582d/internal_photos/bs/2023/8/n/ceaczxRsy0P4QxaWh7sQ/rizia.png)