Low-Income Housing Tax Credit Program

5 (128) In stock

The Fund is responsible for administering the Low-Income Housing Tax Credit Program, which generates low-income residential rental units by encouraging private investment through federal tax credits. Since its inception, this program has produced more than 17,200 affordable rental units in West Virginia. If you are interested in receiving updates on the Fund’s Low-Income Housing Tax […]

IRA Tax Breaks May Reinforce Inequities, So We Need to Help

McKee proposes tax credit program to spur production of affordable

Driving Community Impact with LIHTC

Low Income Housing Tax Credit Communities – Greenwich Communites

The American Jobs Plan Would Mean Major LIHTC Expansion

Wha is the Low-Income Housing Tax Credit Program in Arizona

The Weakness of Neighborhood Revitalization Planning in the Low

LIHTC Funding: Insights for Investors & Developers

Low-Income Housing Tax Credit Program

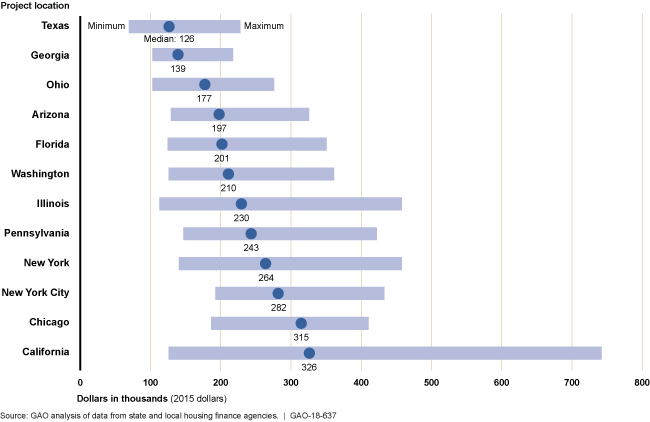

Low-Income Housing Tax Credit: Improved Data and Oversight Would Strengthen Cost Assessment and Fraud Risk Management

Pending Low-Income Tax Credit Expiration Could Cost 2,000 Affordable Homes - The Urbanist

LIHTC for Regular People — Shelterforce Shelterforce

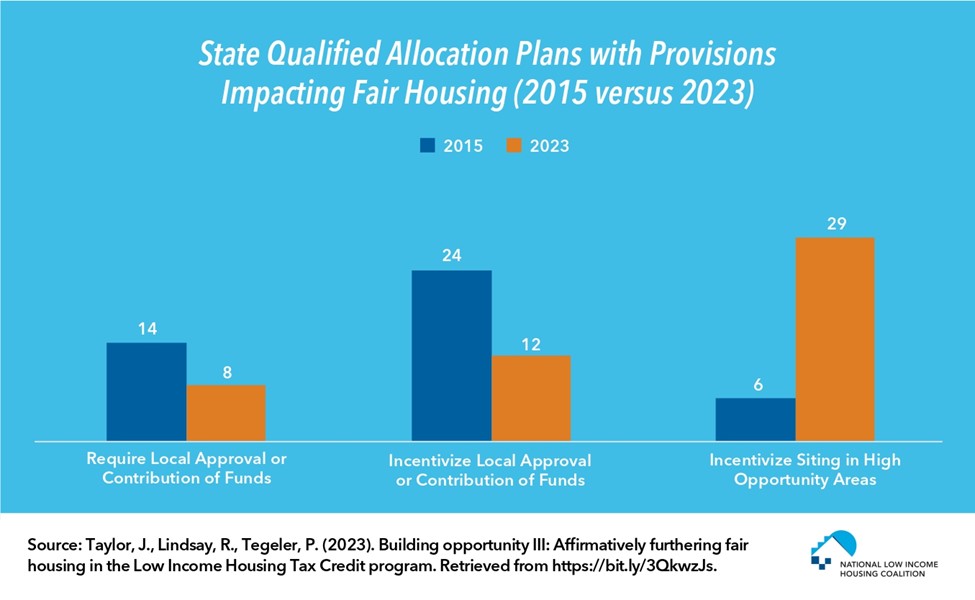

States Have Strengthened Qualified Allocation Plans to Promote

How Do Low-Income Families Spend Their Money?

Low Income Housing Tax Credit – IHDA

Low-income housing: The negative effects on both physical and