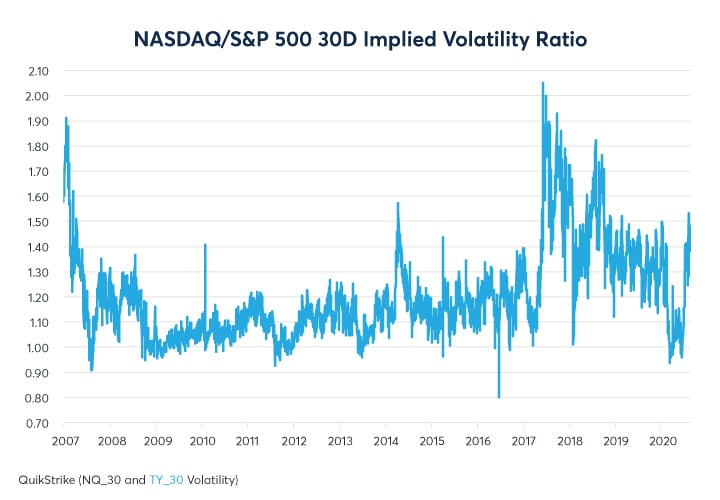

NASDAQ 100-S&P 500 Volatility Ratio at Peak Levels - CME Group

4.8 (800) In stock

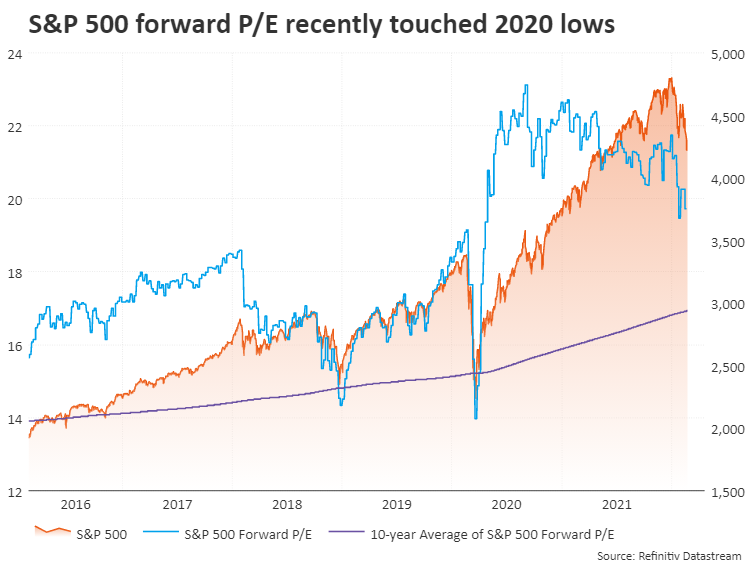

Stocks Cross the Line Into 'Bear Market' as Inflation Worries Peak Before Pivotal Fed Meeting

LIVE MARKETS U.S. stocks rebound to end higher, led by tech rally

Page 154 Micro E-mini Nasdaq-100 Index Futures (Dec 2023) Trade Ideas — CME_MINI:MNQZ2023 — TradingView

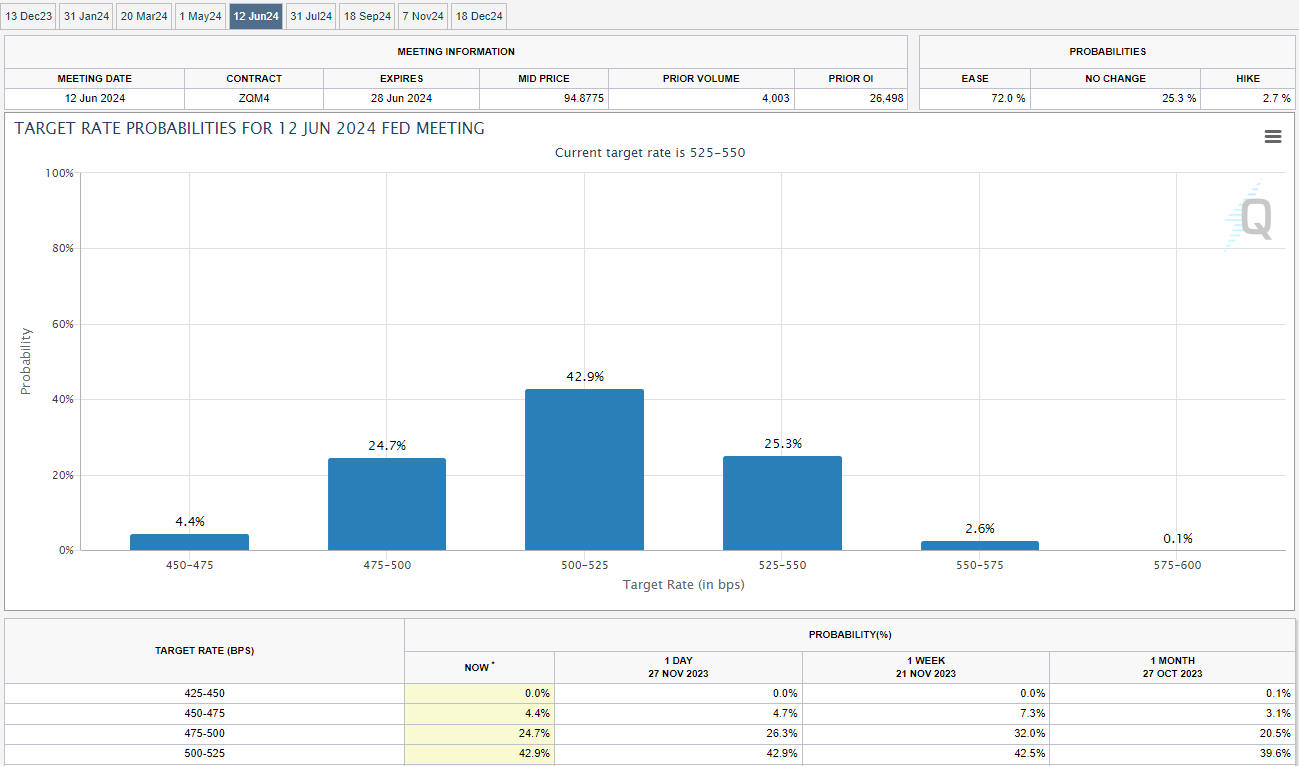

GEX – Gamma Exposure – Physik Invest

NASDAQ 100-S&P 500 Volatility Ratio at Peak Levels - CME Group

S&P 500: Why 2024 Could Be The Worst Year Since 2008 (SP500)

Spotlight on XYLD: An S&P 500 Covered Call Strategy – Global X ETFs

Nasdaq 100: Today's Move to Decide If Correction Is Starting - Watch This Level

The Search for Yield – Equity Income Whitepaper – Global X ETFs

S&P 500 Falls Into Bear Market - The New York Times

Watch Bloomberg Markets: The Close 10/24/2023 - Bloomberg

3 S&P 500 Giants Worth Buying as Their Shares Climb to Fresh Highs

Nasdaq 100 Long-Term Trend • Chart of the Day

Nasdaq 100 index annual returns 2024

Nasdaq -100 e-mini futures give heavy exposure to technology, innovation

This Sparkling Air Jordan 1 Low PE Was Created For the Jordan Brand Classic

This Sparkling Air Jordan 1 Low PE Was Created For the Jordan Brand Classic The Walking Dead: The Complete First Season [Blu-ray]: : Andrew Lincoln, Jon Bernthal: Movies & TV Shows

The Walking Dead: The Complete First Season [Blu-ray]: : Andrew Lincoln, Jon Bernthal: Movies & TV Shows Letter V PNG Stock Photo - PNG Play

Letter V PNG Stock Photo - PNG Play Pinterest

Pinterest SEXY SPARKLES Rhinestone Bra Chain Sexy Harness Bikini Body

SEXY SPARKLES Rhinestone Bra Chain Sexy Harness Bikini Body Small breasts wear a high-end, slim and elegant lady-goddess style gen – Lee Nhi Boutique

Small breasts wear a high-end, slim and elegant lady-goddess style gen – Lee Nhi Boutique