Unrecaptured Section 1250 Gain: What It Is, How It Works, and Example

4.5 (477) In stock

:max_bytes(150000):strip_icc()/Unrecaptured-1250-gain_final-f74610188e8542aba3a79c35408552b9.png)

Unrecaptured section 1250 gain is an IRS tax provision where depreciation is recaptured when a gain is realized on the sale of depreciable real estate.

:max_bytes(150000):strip_icc()/GettyImages-89031228-4b17a4c6f4ea4a95b3bddc9a6f9d7d65.jpg)

Short-Term Loss: Meaning, Examples, and FAQs

:max_bytes(150000):strip_icc()/form-1099-b.asp-final-1248911001ae4988af1ce6fc62ece795.png)

Form 4797: Sales of Business Property Definition: What It Is and How to File

:max_bytes(150000):strip_icc()/GettyImages-160616076-5b11ad0952424bcbbaf08301bdd6515c.jpg)

Form 4797: Sales of Business Property Definition: What It Is and How to File

:max_bytes(150000):strip_icc()/139677444-5bfc394e46e0fb005148a3aa.jpg)

Capital Gains Tax: What It Is, How It Works, and Current Rates

:max_bytes(150000):strip_icc()/GettyImages-979885068-b7c1fcde402f4740adf72c2e534d5838.jpg)

Adjusted Cost Basis: How to Calculate Additions and Deductions

Section 1231 Property: Definition, Examples, and Tax Treatment

:max_bytes(150000):strip_icc()/two-business-people-calculate-their-business-in-the-office--918789230-666e4913bd87455883cf703264d24085.jpg)

Depreciable Property: Meaning, Overview, FAQ

:max_bytes(150000):strip_icc()/shutterstock_272610017-5bfc35e046e0fb00511b9dbf.jpg)

How Does a Tax-Free Exchange Work?

:max_bytes(150000):strip_icc()/IMG_20171216_182148727_LL-4f9a9d7d74714f95b116a7182aa20ecf.jpg)

Alicia Tuovila

:max_bytes(150000):strip_icc()/vacation-home-kitchen-ideas-577560a43df78cb62c4083cc.jpg)

Avoid Capital Gains Tax on Your Investment Property Sale

:max_bytes(150000):strip_icc()/EB03cropped-f264eb8ba4b545dd85243fd7e32caf35.jpg)

Section 1245: Definition, Types of Property Included, and Example

:max_bytes(150000):strip_icc()/Unrecaptured-1250-gain_final-f74610188e8542aba3a79c35408552b9.png)

Unrecaptured Section 1250 Gain: What It Is, How It Works, and Example

:max_bytes(150000):strip_icc()/89794268-5bfc2b8bc9e77c005143f0cf.jpg)

Constructive Sale Rule, Section 1259: What it is, How it Works

:max_bytes(150000):strip_icc()/form-1099-int.asp-final-2599de13e6834f20ae53280607b01e17.jpg)

Tax Laws & Regulations

Pain & Gain: the true story behind the movie, Movies

Bra Jacquemus 'Le Haut Meli' Bra Off-White 22H223TO023-1061

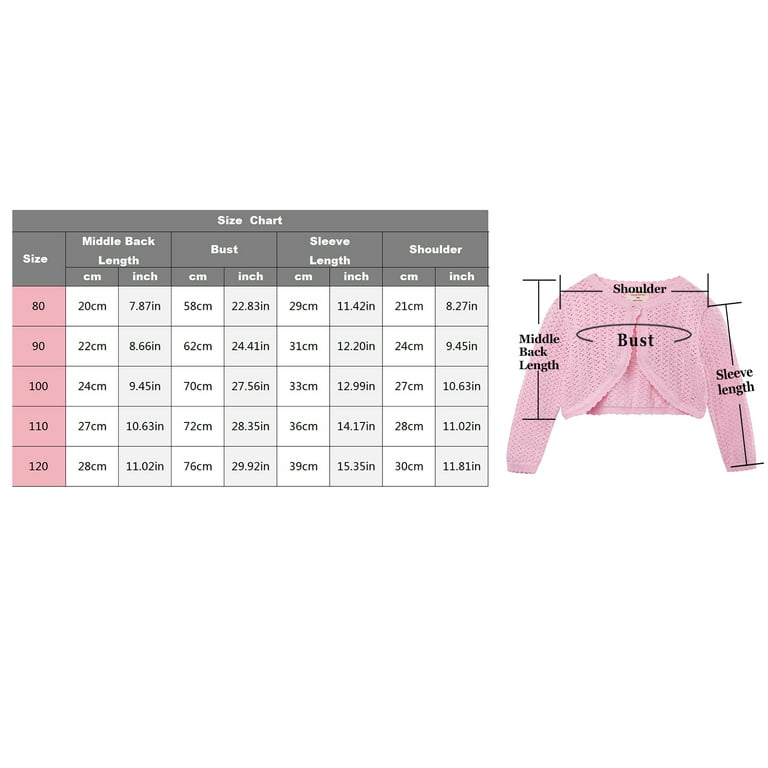

Bra Jacquemus 'Le Haut Meli' Bra Off-White 22H223TO023-1061 JuJu Jams Pascale Cardigan

JuJu Jams Pascale Cardigan Little Girls' Long Sleeve Knit Bolero Shrug Cardigan All Match

Little Girls' Long Sleeve Knit Bolero Shrug Cardigan All Match Shyaway lingerie on X: BUY THE IDEAL - FITTING SPORTS BRA ONLINE SHOPPING IN INDIA #sportsbra #sportsbraonline #sportsbraindia / X

Shyaway lingerie on X: BUY THE IDEAL - FITTING SPORTS BRA ONLINE SHOPPING IN INDIA #sportsbra #sportsbraonline #sportsbraindia / X Luxury Solid Brass Coat & Wall Hooks - Armac Martin

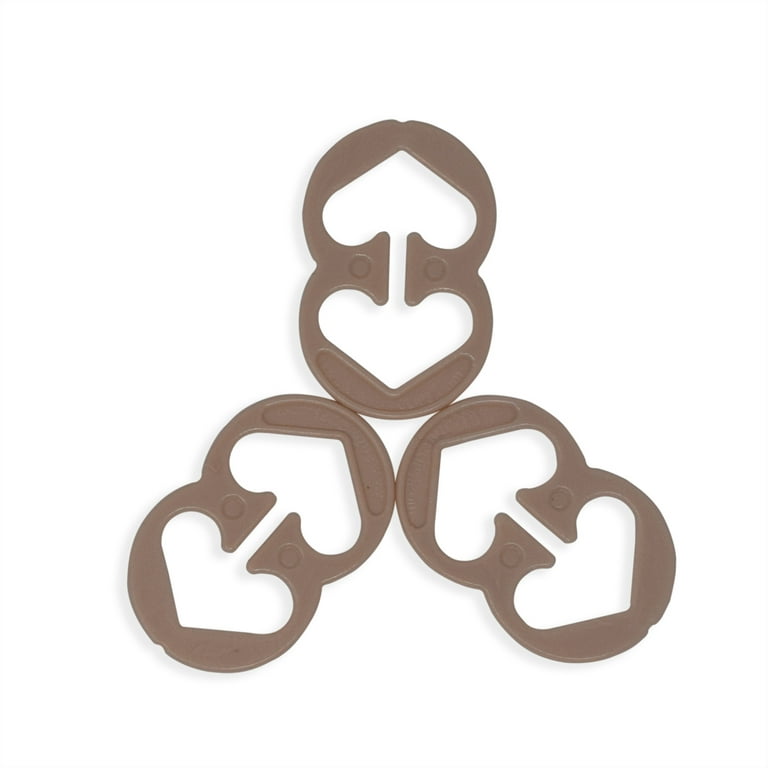

Luxury Solid Brass Coat & Wall Hooks - Armac Martin Razor Clips Bra Strap Clips Made in the USA Racer Back Conceal Straps (Beige)

Razor Clips Bra Strap Clips Made in the USA Racer Back Conceal Straps (Beige)